Deliver the best UX

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Recognise every recurring payment, subscription or direct debit and provide your analysts and customers control and predictability.

The amount of automated payments, their frequency and regularity can be hard to control for many people and can even put them in a difficult situation.

Help your customers stay on top of their finances by giving them a clear view of their recurring payments, subscriptions or direct debits, while predicting their future spending and ability to meet their financial obligations.

Forrester estimates subscription-related disputes alone cost banks $136 million per year. Recurring payments go far beyond streaming services.

Provide value-added services and meet evolving customer needs and offer features that turn your app into a proactive financial partner.

Gain a clearer understanding of clients' recurring payments and monthly outflows and leverage subscription data to deliver tailored financial recommendations and offers.

Reduce losses due to your clients’ inability to fulfill their financial obligations and use insights to guide customers toward smarter spending and saving habits.

Elevate financial transparency for your clients with comprehensive insights into recurring charges and help users easily manage and cancel unwanted subscriptions.

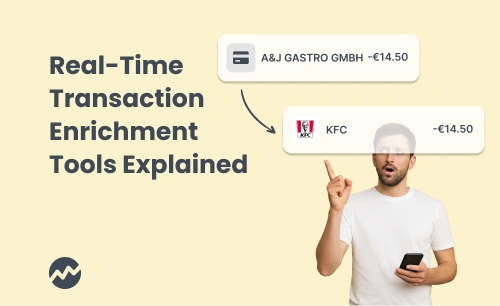

Take advantage of highly detailed labeling based on a combination of values up to the store level.

91şÚÁĎÍř recognises recurring payments from one-time payments on a single terminal.

Utilise knowledge of payment frequency to predict and understand future financial outflows

Notify clients of upcoming recurring payments—whether or not they’re set as standing orders.

Discover other data solutions that amplify your application engagement and take your user experience to the next level.

Meet all the requirements of AN 4569 Revised Standard

Fuel digital transactions with accurate merchant insights

Provide the best possible experience to clients when searching for a place to withdraw money

Explore how 91şÚÁĎÍř can help you get the most from transaction data, increase your app engagement and turn UX into your competitive advantage.